Checkout our Customer Reviews!

₨ 1,200

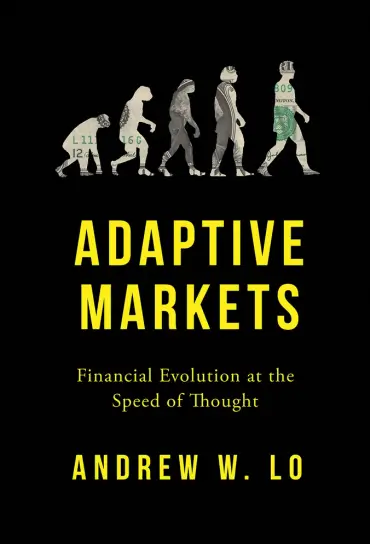

Adaptive Markets: Financial Evolution at the Speed of Thought

Learn about the changing financial landscape in Andrew W. Lo’s Adaptive Markets. Order from Alpha Readers Club online in Pakistan

- Author

- Category

- Product SKU

- : John Doe

- : Trading & Investing

- : B-501

- Category

- Product SKU

- : Trading & Investing

- : B-501

Description

Andrew W. Lo’s revolutionary book Adaptive Markets: Financial Evolution at the Speed of Thought expands how we see financial markets. Beyond the typical efficient market hypothesis, Lo presents the Adaptive Markets Hypothesis (AMH), which explains how markets genuinely function by fusing ideas of evolutionary biology with economic theory.

Lo argues that financial markets are adaptable rather than totally random or absolutely logical. Like species in nature, traders, investors, and financial institutions change, grow, learn, and adjust to new circumstances. This dynamic approach clarifies market events like behavioural biases, bubbles, and crashes that conventional theories cannot explain.

The book examines the evolution of financial ideas, from traditional economics to behavioural finance, emphasising its strengths and limitations. Lo then builds on these concepts to provide AMH as a more realistic and adaptable model for analysing market behaviour. Examining actual cases—from the 2008 financial crisis to the explosive use of technology in trading—Lo demonstrates how dynamically changing financial markets are.

Readers will discover why risk management is so important, why diversity is sometimes useless, and how creativity can overnight revolutionise markets. Both individual investors and organisations attempting to stay afloat in the ever-shifting financial environment need to be nimble, according to Lo.

Not just for scholars, but also for traders, investors, economists, and everyone else curious in the actual character of markets, Adaptive Markets is required reading. on the realm of finance, it presents a new viewpoint on risk, possibility, and survival on the planet.

Find out about a revolutionary way of thinking about money by ordering Adaptive Markets, written by Andrew W. Lo, from Alpha Readers Club, which is now available online in Pakistan.

Welcome to Alpha Readers Club, your one-stop destination for discovering a world of stories, knowledge, and inspiration!

Useful Links

Contact Details

- +92 349 047 0465

- alphareadersclub@gmail.com

- Lahore Cantt.

Reviews

There are no reviews yet.